Mileagewise - Reconstructing Mileage Logs Things To Know Before You Get This

Mileagewise - Reconstructing Mileage Logs Things To Know Before You Get This

Blog Article

Getting My Mileagewise - Reconstructing Mileage Logs To Work

Table of ContentsUnknown Facts About Mileagewise - Reconstructing Mileage LogsThe 10-Second Trick For Mileagewise - Reconstructing Mileage LogsSome Known Details About Mileagewise - Reconstructing Mileage Logs 10 Simple Techniques For Mileagewise - Reconstructing Mileage LogsOur Mileagewise - Reconstructing Mileage Logs PDFsThe Ultimate Guide To Mileagewise - Reconstructing Mileage LogsWhat Does Mileagewise - Reconstructing Mileage Logs Do?

Timeero's Fastest Range function suggests the quickest driving path to your employees' location. This feature improves performance and contributes to cost savings, making it an important property for businesses with a mobile labor force.Such an approach to reporting and compliance simplifies the usually complex job of taking care of mileage expenditures. There are numerous benefits connected with making use of Timeero to maintain track of mileage.

More About Mileagewise - Reconstructing Mileage Logs

With these tools in operation, there will be no under-the-radar detours to increase your reimbursement prices. Timestamps can be found on each gas mileage access, improving reliability. These additional verification actions will keep the internal revenue service from having a reason to object your gas mileage records. With exact gas mileage tracking modern technology, your workers do not have to make harsh gas mileage quotes or perhaps bother with mileage expense monitoring.

If a worker drove 20,000 miles and 10,000 miles are business-related, you can create off 50% of all car expenditures (mileage log for taxes). You will require to continue tracking mileage for work even if you're utilizing the actual expense technique. Keeping gas mileage records is the only means to separate service and individual miles and provide the proof to the IRS

The majority of gas mileage trackers allow you log your trips manually while computing the distance and repayment amounts for you. Lots of also included real-time journey monitoring - you need to begin the app at the beginning of your journey and quit it when you reach your last destination. These applications log your begin and end addresses, and time stamps, in addition to the total distance and repayment amount.

Mileagewise - Reconstructing Mileage Logs Fundamentals Explained

This includes expenses such as fuel, maintenance, insurance coverage, and the car's devaluation. For these expenses to be considered insurance deductible, the car ought to be made use of for organization objectives.

The Best Guide To Mileagewise - Reconstructing Mileage Logs

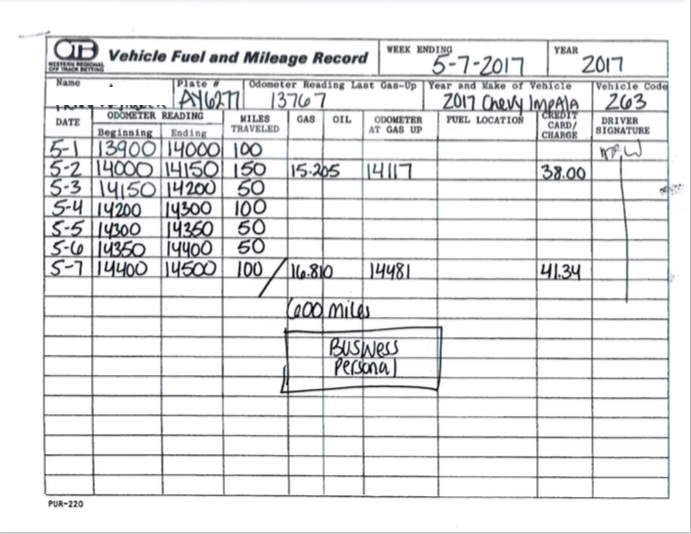

Begin by videotaping your cars and truck's odometer reading on January first and after that once more at the end of the year. In between, diligently track all your business trips noting down the beginning and ending analyses. For each journey, record the area and business purpose. This can be simplified by keeping a driving visit your car.

This includes the overall service mileage and complete gas mileage build-up for the year (business + personal), journey's day, destination, and function. It's vital to videotape tasks immediately and maintain a coeval driving log describing day, miles driven, and organization purpose. Here's just how you can improve record-keeping for audit purposes: Beginning with making certain a meticulous mileage log for all business-related traveling.

Unknown Facts About Mileagewise - Reconstructing Mileage Logs

The actual costs approach is an alternative to the conventional gas mileage price technique. Rather of computing your deduction based upon a fixed rate per mile, the real expenditures technique enables you to deduct the actual expenses associated with utilizing your vehicle for company functions - best free mileage tracker app. These expenses include gas, upkeep, repairs, insurance, devaluation, and various other associated click to investigate costs

However, those with significant vehicle-related expenses or distinct conditions might gain from the actual expenditures technique. Please note choosing S-corp status can change this estimation. Inevitably, your selected method must align with your details economic goals and tax obligation circumstance. The Standard Gas Mileage Rate is a step provided yearly by the IRS to establish the insurance deductible costs of operating an auto for organization.

5 Easy Facts About Mileagewise - Reconstructing Mileage Logs Described

(https://mi1eagewise.weebly.com/)Whenever you utilize your car for organization journeys, tape-record the miles took a trip. At the end of the year, once again write the odometer reading. Calculate your total business miles by using your start and end odometer analyses, and your taped company miles. Accurately tracking your specific mileage for organization journeys aids in validating your tax obligation reduction, especially if you opt for the Criterion Gas mileage method.

Maintaining track of your mileage manually can need diligence, however keep in mind, it can conserve you money on your taxes. Tape the total gas mileage driven.

Unknown Facts About Mileagewise - Reconstructing Mileage Logs

In the 1980s, the airline industry ended up being the first industrial individuals of GPS. By the 2000s, the shipping sector had taken on general practitioners to track plans. And currently nearly everybody utilizes general practitioners to get around. That implies almost every person can be tracked as they set about their service. And there's snag.

Report this page